Banking instruments refer to the various financial instruments that banks use to facilitate transactions between parties. These instruments can be used to provide guarantees, credit, or other forms of financial support.

An example of these instruments is the Standby Letter of Credit (SBLC) and the Bank Guarantee (BG). They are legal documents issued by a bank that guarantees payment to a beneficiary if the applicant fails to fulfil their contractual obligations. Banking Instruments are often used in international trade as a safety net for both parties involved in the transaction

Both SBLCs and BGs are types of financial guarantees that can be used to mitigate risk in transactions. They are often used in situations where one party is unsure about the other’s ability to fulfil their contractual obligations.

We provide 3 kinds of Bank Instruments:

SBLC

Stand By Letter Of Credit

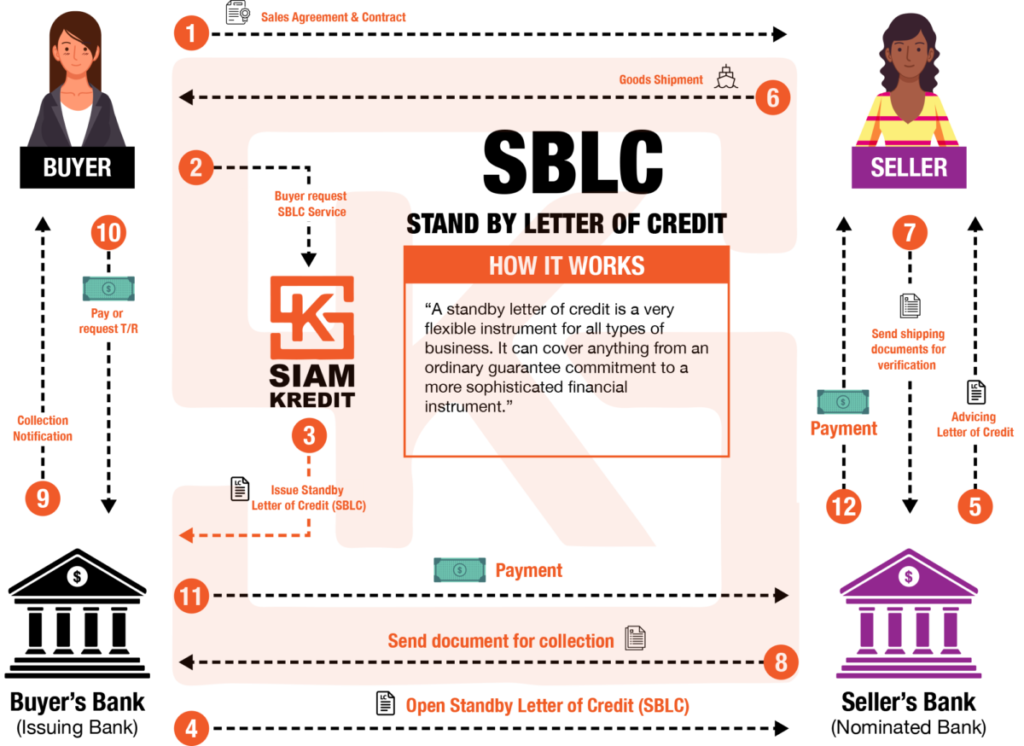

Standby Letter Of Credit (SBLC) is a financial instrument that serves as a guarantee of payment, issued by a bank on behalf of a client. It is a backup plan for the beneficiary in case the applicant fails to fulfil their payment obligations.

BG

Bank Guarantee

A Bank Guarantee (BG) is a type of financial instrument issued by a bank on behalf of a client. It serves as a guarantee that client will fulfil their financial obligations to a third party, up to the amount specified in the BG.

MTN

Medium Term Note

This is a type of debt note that usually matures in Five to Ten Years. Banks usually issue MTNs, however, you also get Corporate MTNs. For Corporate MTNs, this type of debt program is used by a company so it can have constant cash flows coming in from its debt issuance it allows a company to tailor its debt issuance.

How does it all work?

The below charts explain the way Monetisation and CIF trades work